Steel Industry Demand 2024

In a recent comprehensive market survey conducted by Longyue Company, our expert analysts have uncovered promising trends indicating a robust outlook for the steel industry in the year 2024. Leveraging our strategic insights and rigorous analysis, Longyue Company is pleased to share valuable findings that suggest the steel sector is poised for growth beyond market expectations.

A thorough examination reveals that institutions are anticipating a robust demand surge within the steel industry for 2024. The driving forces behind this optimistic outlook include sustained support from domestic macro policies and heightened expectations of an interest rate cut by the Federal Reserve. These factors are expected to contribute to a warming trend in the construction steel sector, potentially leading to an upswing in steel mill operating rates. The positive momentum is further expected to create a favorable environment for coking coal demand, with stabilizing prices of raw materials like iron ore and coking coal.

Supply-Demand Dynamics

Crude steel production, which peaked at 1.065 billion tons in 2020, has plateaued and is projected to decline by 1.5% to approximately 1.021 billion tons in 2024. Structural adjustments in downstream steel demand, coupled with reduced drag from the real estate sector, are expected to contribute to a stabilization and growth of steel demand in 2024.

Raw Material Support and Supply-Demand Improvements

Short-term support for steel prices is expected from low iron ore inventories and a decline in the US dollar index. Additionally, tight supply-demand balance and low inventories in coking coal may pave the way for price increases. The combination of raw material support and supply-demand improvements is anticipated to drive a recovery in industry profits.

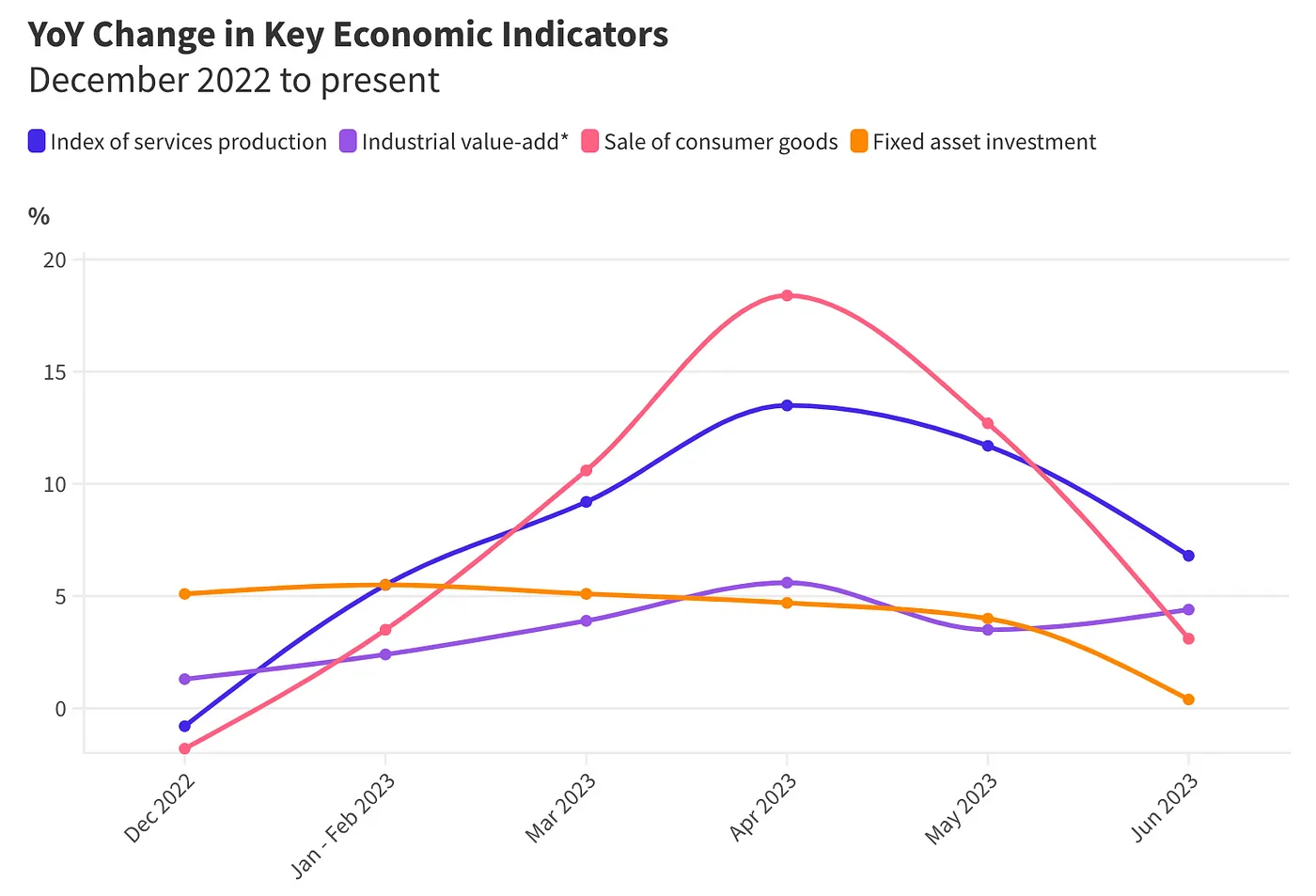

A Tapestry of Investment: Building Futures with Steadfast FAI

China’s steady post-pandemic recovery is interwoven with a tapestry of investment achievements. A breathtaking 3.8% rise in fixed asset investment (FAI) over the same period in 2022 mirrors a nation unwavering in its pursuit of progress. The crescendo is particularly pronounced in high-tech industries, soaring at an impressive 12.5% year-on-year. Yet, the tale is one of contrasts, with property development taking a backseat while infrastructure and manufacturing investments dazzle on center stage.

Industry Transformation

The ongoing theme in the steel industry is transformation and upgrading. The focus on “high-end, intelligent, and green” development is expected to enhance the industry’s profitability. China’s commitment to the transformation and upgrading of the manufacturing industry, particularly in the context of the “dual circulation” development pattern, is set to boost the proportion of special steel in the overall steel supply.

Understanding China’s Iron Ore Imports: Insights from MaQin Investment Group

Anticipated Developments

Looking ahead, 2024 is expected to witness a gradual stabilization and rebound in demand. The proportion of real estate demand is projected to fall below 20%, reducing the sensitivity of steel demand to real estate fluctuations. The decline in new housing starts is expected to narrow, and the negative impact of real estate on the steel industry is anticipated to decrease significantly. Support from national bonds for infrastructure demand and advancements in industries like automobiles, home appliances, and shipbuilding are expected to contribute to overall demand stability.

Stock Recommendations

Xingye Securities Emphasizes opportunities in the steel sector, particularly profit expansion in sheet metal driven by the recovery of manufacturing demand. Key companies to watch include Hualing Steel, Baosteel, Xinsteel, and Nangang Steel.

Guotai Junan Recommends companies with upgraded product structures, technological leadership, and low-cost operations. Highlighted companies include Hualing Steel, Baosteel, Shougang, Fangda Special Steel, Xinsteel, Xingzhong Pipe, Jinzhou Pipeline, and Youfa Group.

Dongguan Securities Optimistic about upstream resource companies with long-term advantages, suggesting investments in companies like Hesteel Resources, China Minmetals, and Anning Shares.

This press release relies on Longyue Company’s exclusive market research and analysis. The findings are sourced from research reports by Xingye Securities, Huafu Securities, Guotai Junan, and Dongguan Securities. Although the information is obtained from reputable sources, Longyue Company encourages readers to use their own judgment and discretion when making investment decisions. We take pride in delivering precise and insightful analyses, establishing ourselves as a reliable partner for stakeholders in the steel industry.