Belt and Road Initiative Investments

Embark on a strategic journey towards prosperity with Kamal Heidar Tamini’s expert insights on “Belt and Road Initiative Investments.” This comprehensive guide delves into the intricacies of navigating opportunities and mitigating risks within the global economic landscape. Tamini’s analysis covers the initiative’s framework, background, and case studies, providing investors with essential knowledge to unlock success. From understanding the initiative’s policies to identifying investment opportunities in areas like infrastructure, energy, and logistics, this article offers a roadmap for making informed decisions. Stay ahead in the dynamic world of international investments by leveraging Tamini’s expertise and gaining a deeper understanding of Belt and Road Initiative Investments.

Abstract

Since its proposal in 2013, the Belt and Road Initiative (BRI) has become one of the most closely watched topics globally. As an important platform for China’s opening-up to the outside world, the initiative involves more than 60 countries and regions, bringing both extensive opportunities and challenges to the world economy. For investors, how to achieve success in BRI investments has become an important task. This article analyzes the framework and background of the initiative, investment opportunities and risks, investment strategies, and case studies, to explore how to achieve success in BRI investments and how the initiative will help us gain and increase investments.

Introduction

The Belt and Road Initiative (BRI) is a major initiative proposed by China, aimed at promoting connectivity, economic and trade cooperation, and cultural exchange among countries and regions along the route. The initiative covers a wide range of areas, including infrastructure construction, trade and investment, financial cooperation, and cultural exchange. With the support of the Chinese government, the BRI has become an important national strategy, bringing rich opportunities and challenges to domestic and foreign investors. For investors, how to achieve success in BRI investments has become an important issue.

Initiative Framework and Background

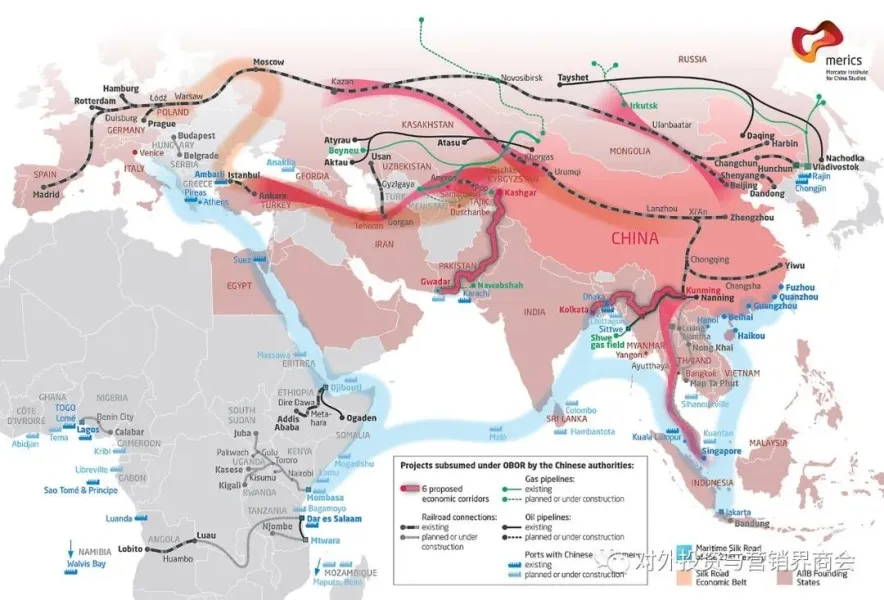

The Belt and Road Initiative, proposed by Chinese President Xi Jinping in 2013, aims to promote economic cooperation and cultural exchange among countries and regions along the routes of the ancient Silk Road. The initiative includes two parts: the Silk Road Economic Belt and the 21st Century Maritime Silk Road, covering countries and regions in Asia, Africa, Europe, and the Middle East.

The initiative proposes a series of important initiatives, including infrastructure construction, trade and investment facilitation, and people-to-people exchanges, providing broad opportunities for investors. As of 2021, more than 140 countries and international organizations have signed Belt and Road cooperation documents with China, involving billions of dollars in investment.

Evaluating Investment Opportunities

Understanding the local economic, political, and legal environment is key to evaluating investment opportunities. Investors need to consider the local market demand and potential for growth, understand policies and regulations, as well as learn about local business culture and practices.

In addition, investors should also consider the priority areas mentioned in the initiative, such as infrastructure, energy, manufacturing, and agriculture, as well as the preferential policies and trade agreements mentioned in the initiative. Through in-depth research and analysis, investors can find the most promising investment opportunities.

Understand the Initiative Framework and Policies

Before investing in Belt and Road Initiative projects, investors should first understand the framework and policies of the initiative. The initiative aims to strengthen economic ties and cooperation among countries and regions along the routes, especially in infrastructure, trade, and investment. Additionally, the Chinese government has taken many measures to support investors, such as opening up markets, providing preferential policies, and supporting cross-border investment. Investors need to understand these policies and frameworks to formulate appropriate investment strategies.

Identify Investment Opportunities

The initiative covers many fields, including infrastructure, energy, logistics, finance, and more. In these fields, investors can identify potential investment opportunities. For example, the infrastructure sector requires a large amount of investment, including railways, highways, ports, airports, and more. The energy sector also requires a large amount of investment, including oil, natural gas, renewable energy, and more. Investors can identify potential investment opportunities by understanding the focus areas of the initiative.

Analyze Risks and Challenges

Although the Belt and Road Initiative brings many opportunities, it also brings many risks and challenges. For example, political instability, legal risks, currency risks, and more. In addition, the feasibility, sustainability, and social responsibility of projects also need to be carefully considered. Investors need to carefully analyze these risks and challenges and formulate corresponding risk management strategies.

“Bridging Opportunities, Navigating Challenges: Unveiling Success in Belt and Road Investments! ”

Understanding China’s Iron Ore Imports: Insights from MaQin Investment Group

Understand the Initiative Framework and Policies

Before investing in Belt and Road projects, investors need to understand the framework and policies of the initiative. The initiative aims to strengthen economic ties and cooperation among countries and regions along the route, especially in infrastructure, trade, and investment. At the same time, the Chinese government has taken many measures to support investors, such as opening up markets, providing preferential policies, and supporting cross-border investment. Investors need to understand these policies and frameworks to develop appropriate investment strategies.

Identify Investment Opportunities

The initiative covers many areas, including infrastructure, energy, logistics, finance, etc. In these areas, investors can identify potential investment opportunities. For example, the infrastructure sector requires a large amount of investment, including railways, highways, ports, airports, etc. The energy sector also requires a large amount of investment, including oil, natural gas, renewable energy, etc. Investors can identify potential investment opportunities by understanding the key areas of the initiative.

Analyze Risks and Challenges

Although the Belt and Road Initiative brings many opportunities, it also brings many risks and challenges. For example, political instability, legal risks, currency risks, etc. In addition, the feasibility, sustainability, and social responsibility of the projects also need to be carefully considered. Investors need to analyze these risks and challenges carefully and develop corresponding risk management strategies.

Choose the Right Investment Strategy

When choosing an investment strategy, investors need to consider their capital, time frame, and risk preferences. Based on the size of the investor’s capital, direct investment or investment through cooperation or mergers and acquisitions can be selected. Based on the investor’s time frame, long-term or short-term investments can be selected. At the same time, investors also need to consider risk preferences, such as high-risk, high-return or low-risk, low-return investment strategies.

Case Studies

The Belt and Road Initiative has attracted the attention and participation of many investors. For example, Chinese insurance giant China Life Insurance Company has invested in multiple infrastructure projects in Pakistan and Sri Lanka. The US investment company Blackstone Group has also announced plans to invest $10 billion in infrastructure projects in Belt and Road countries. These cases provide references and inspiration for investors.

Future Outlook

The Belt and Road Initiative will continue to advance, and more investment opportunities will appear in the future. According to estimates by the World Bank, Belt and Road countries will need $4.4 trillion in infrastructure investment by 2030. In addition, as the economies of countries and regions along the route develop, more business opportunities will be generated. Therefore, investors need to closely follow the development of the Belt and Road Initiative and seize investment opportunities.

Conclusion

In summary, delving into the intricacies of Belt and Road Initiative Investments, as meticulously outlined by Kamal Heidar Tamini, proves to be a strategic imperative for investors seeking success in the global economic landscape. To thrive in this dynamic environment, investors must not only comprehend the initiative’s framework and policies but also adeptly identify the myriad investment opportunities it presents. Tamini’s expert analysis guides investors through the nuanced process of analyzing risks and challenges inherent in Belt and Road Initiative Investments, enabling them to tailor a robust and effective investment strategy. Drawing inspiration from successful cases and anticipating future development trends becomes pivotal in this pursuit of success. As we navigate the evolving terrain of international investments, Tamini’s comprehensive insights act as a compass, illuminating the path toward triumph in the realm of Belt and Road Initiative Investments.

“The above articles provide advice and case studies on how to achieve success in investing in the Belt and Road Initiative, which can help investors better understand the investment opportunities and challenges of the initiative, develop suitable investment strategies, and achieve success.”

Article References

This collection of articles provides a comprehensive guide on navigating investment landscapes within the Belt and Road Initiative (BRI). Explore insights from reputable sources such as the China Economic Net, Caijing Magazine, Takungpao News, China Trade and Investment Network, China News Network, China International Trade Promotion Committee, China Investment News, Southern Finance Net, and China Securities Journal. From understanding investment strategies and risk management to uncovering emerging market opportunities, this compilation offers a diverse perspective on achieving success in Belt and Road investments. Gain valuable knowledge from analyses, experience sharing, and expert advice to make informed decisions in multicultural and multirisk environments, ensuring better returns in your Belt and Road Initiative investments.